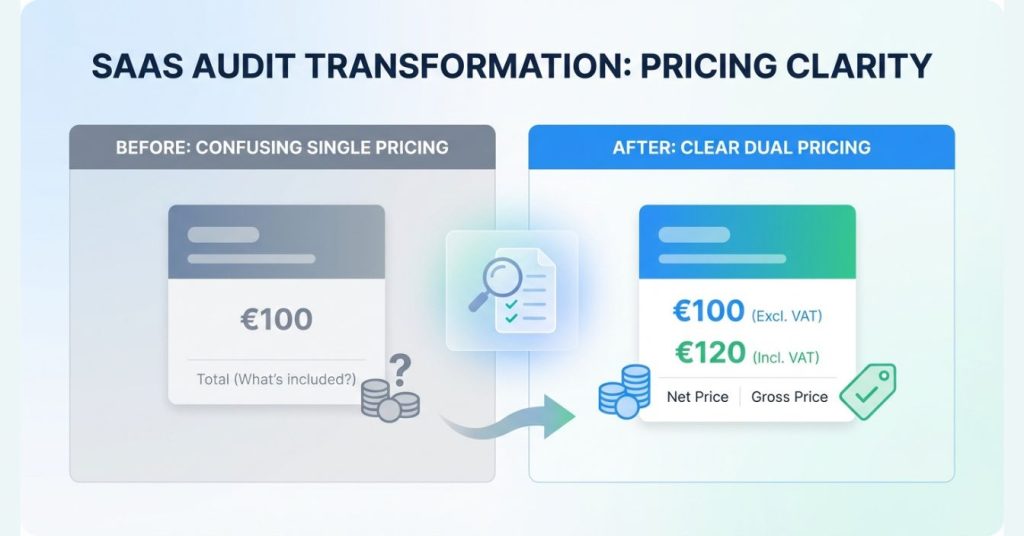

If you sell to both businesses and consumers in the EU, dual pricing is no longer optional.

In 2026, showing only one price on your Shopify store either VAT inclusive or VAT exclusive creates legal risk, buyer confusion, and conversion loss. EU regulators expect transparency, and B2B buyers expect to see net prices (ex-VAT) before they reach checkout.

This guide explains:

- Why dual pricing is mandatory for EU B2B stores

- The EU VAT and transparency rules behind it

- Why Shopify doesn’t support this natively

- All available dual-pricing methods compared

- A no-code setup using a dedicated Shopify app

If your store serves mixed B2B + B2C traffic, this is one of the most important fixes you can make in 2026.

What Is Dual Pricing (And Why EU Buyers Expect It)

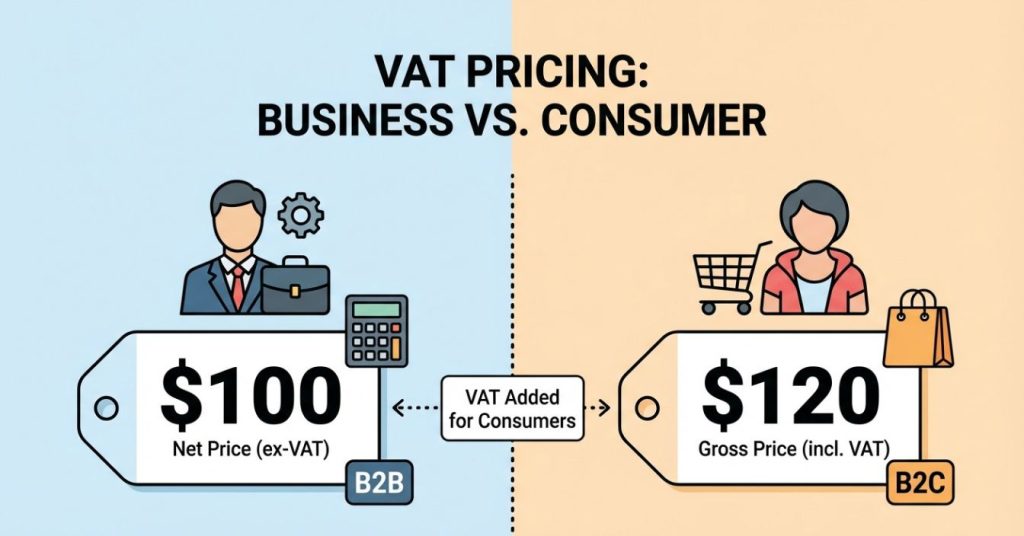

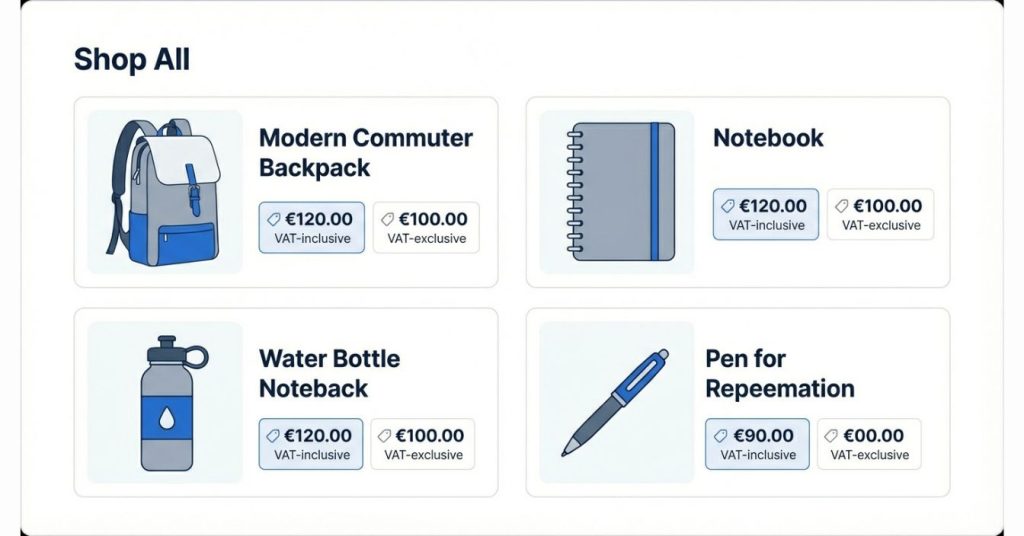

Dual pricing means displaying:

- VAT-inclusive price (for consumers)

- VAT-exclusive price (for businesses)

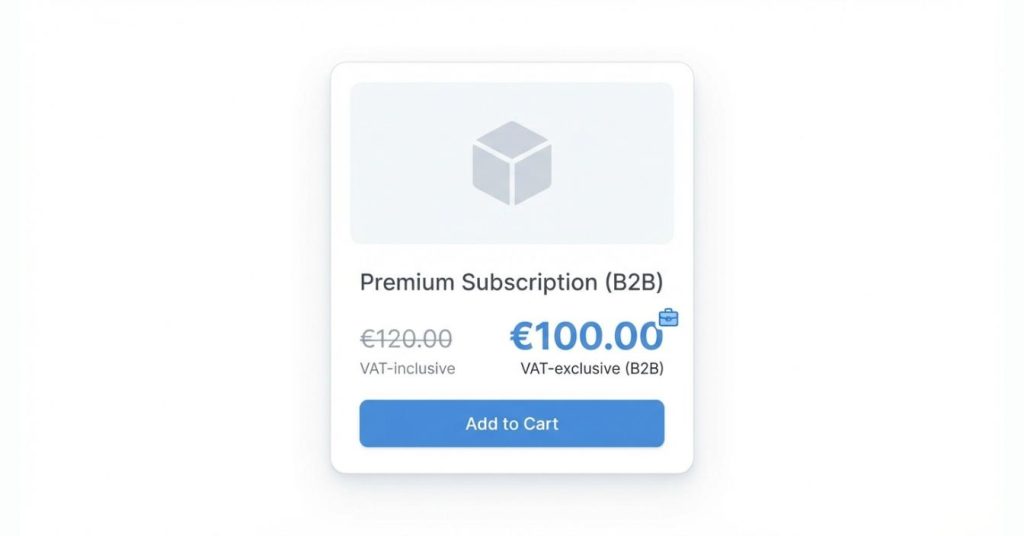

Example on a product page:

€120 (incl. VAT)

€100 (excl. VAT)

For EU B2B buyers, the net price is the real price.

For EU consumers, the gross price is legally required.

Showing only one:

- Confuses B2B buyers

- Causes cart abandonment

- Triggers support tickets

- Creates audit and compliance risk

EU VAT Rules Make Dual Pricing Mandatory

Under EU VAT law:

- Reverse charge applies to most cross-border B2B transactions

- VAT is not charged if:

- Buyer and seller are in different EU countries

- Buyer provides a valid VAT ID

- VAT liability shifts to the buyer

At the same time, EU consumer protection and pricing transparency directives require:

- Clear, upfront pricing

- No misleading tax presentation

- Prices visible before checkout

That means:

B2B buyers must see net prices

B2C buyers must see gross prices

Failing to display both correctly can lead to:

- Regulatory fines

- Forced price corrections

- Disputes with B2B customers

- Lost trust

The Conversion Impact of Dual Pricing

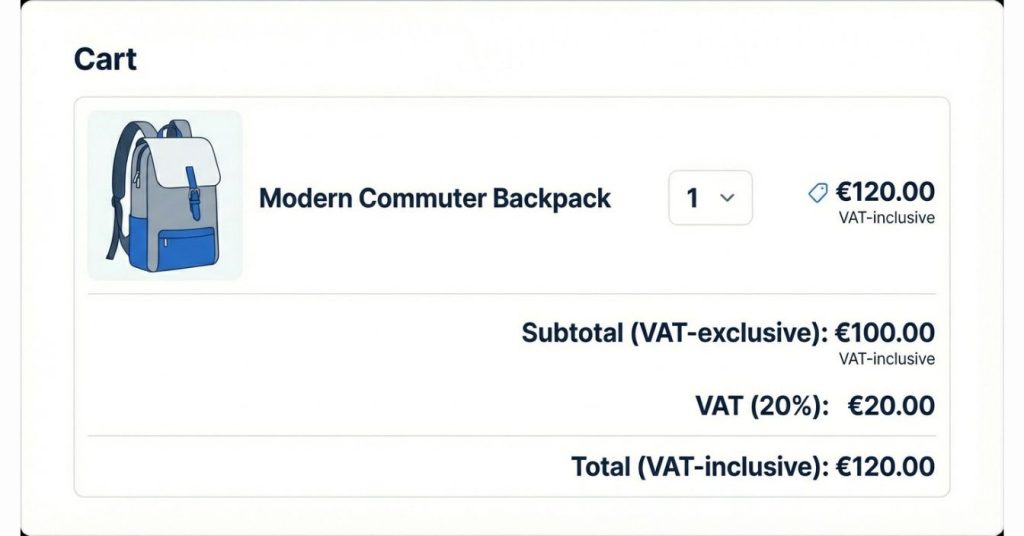

For mixed EU stores (B2B + B2C), dual pricing isn’t just compliance – it’s conversion.

Merchants consistently see:

- 20-30% higher conversion rates for B2B buyers

- Fewer “why did VAT change?” support tickets

- Faster checkout decisions

- Fewer abandoned carts

Single-price stores force buyers to calculate VAT mentally, which kills momentum.

Not sure if your Shopify store is legally and commercially safe for EU B2B pricing?

Many stores charge the right VAT but display prices the wrong way.

👉 Run a FixMyStore AI Audit before regulators or customers flag it

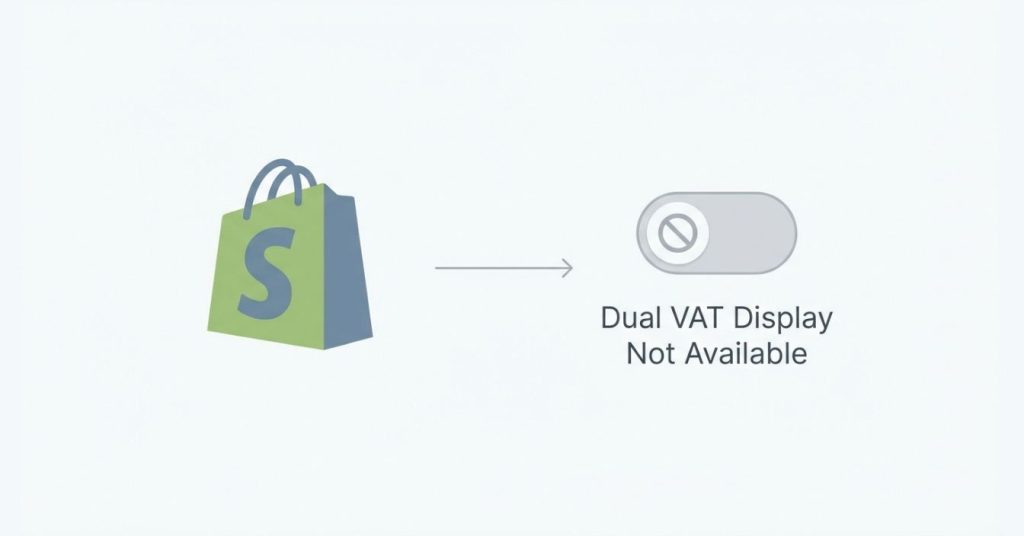

Why Shopify Doesn’t Handle Dual Pricing Natively

Shopify handles tax calculation, not tax transparency.

Shopify Limitations

- Shopify Tax calculates VAT correctly

- But does not show VAT-inclusive and VAT-exclusive prices together

- Standard Shopify plans have:

- No VAT toggle

- No B2B net-price view

- No storefront dual pricing

Shopify Plus Reality

- Shopify B2B (Plus-only) supports company catalogs

- Price lists can be assigned to companies

- But:

- No built-in dual VAT display

- No inclusive/exclusive side-by-side pricing

- Costs €2,000+/month

For most EU merchants, apps are the only practical solution.

Dual Pricing Methods Compared

| Method | Requirements | Pros | Cons |

|---|---|---|---|

| Manual theme edits | Custom code | Free | Breaks on updates, no automation |

| Shopify Plus catalogs | Plus plan | Company pricing | No VAT dual display, expensive |

| Basic competitor apps | Any plan | Simple dual text | Limited rules, weak EU logic |

| F: VAT Dual Price | Any plan | EU-specific rules, VIES, multilingual | Paid |

Apps clearly outperform native options for EU-specific VAT transparency.

How Dual Pricing Works Technically (Without Code)

A proper dual-pricing setup works like this:

- App injects storefront blocks

- Displays:

- VAT-inclusive price

- VAT-exclusive price

- Works across:

- Product pages

- Collection pages

- Search results

- Cart (important)

- Rules decide which price applies:

- Country

- Product / variant

- Collection

- Customer tag

- VAT IDs validated via VIES

- Labels translated (MwSt, TVA, BTW, etc.)

All of this happens without editing theme files.

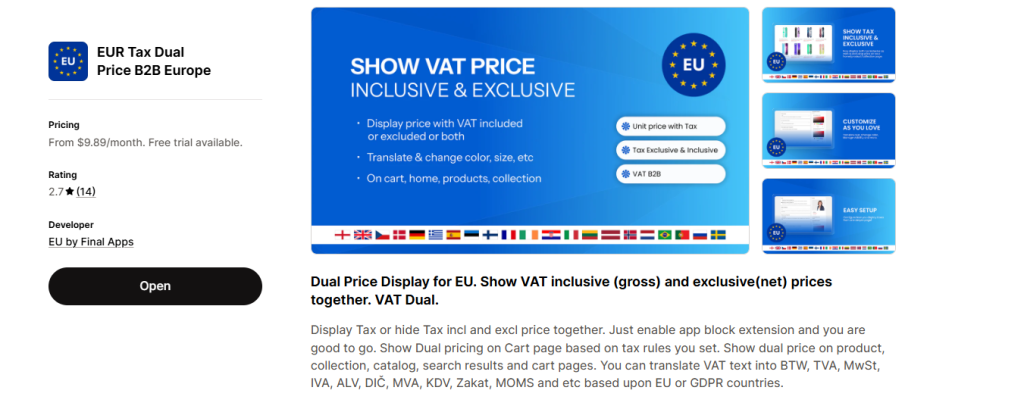

Recommended App: F: VAT Dual Price Display B2B

F: VAT Dual Price Display B2B is built specifically for EU merchants who need VAT-inclusive and VAT-exclusive pricing done right.

What It Does Well

- Shows gross + net prices side-by-side

- Works on:

- PDPs

- Collections

- Cart

- Supports VIES VAT validation

- Country-specific VAT rules

- Per-product, per-variant, per-collection logic

- 25+ EU languages

- No theme overrides (safe uninstall)

Despite mixed public reviews (often tied to theme conflicts), many merchants highlight fast fixes via support once configured correctly.

Pricing:

- Basic – $19/month

All-product dual pricing - Pro – $29/month

Product, variant, and country rules - Premium – $49/month

Cart dual pricing + advanced logic

Integrates well with:

- VAT exemption apps

- PDF invoice tools

- EU GDPR apps

Step-by-Step: Set Up Dual Pricing on Shopify (No Code)

Step 1: Enable Taxes

Go to Settings → Taxes

- Configure EU VAT rates

- Activate Shopify Tax if eligible

Step 2: Install the App

Install F: VAT Dual Price Display B2B from the Shopify App Store

Approve access to:

- Products

- Themes

- Pricing display

Step 3: Configure Display

Choose where to show dual pricing:

- Product pages

- Collection pages

- Cart (Premium)

Select:

- Inclusive + exclusive labels

- Position and formatting

Step 4: Set Rules (Pro+)

- Define rules by:

- Country (e.g., DE 19%)

- Product or tag

- Enable VIES validation for B2B exemptions

Step 5: Customize & Test

- Adjust text, color, font

- Test:

- EU B2C → gross prices

- EU B2B → net prices

- Cart totals

- VAT exemption flow

Common Dual Pricing Pitfalls (And How This Fixes Them)

Theme conflicts?

Uses safe theme blocks. No permanent code changes.

Prices disappear after install?

Usually a theme formatting issue – support resolves quickly.

Non-EU traffic?

Country rules adapt automatically.

Same-country B2B?

VAT applies correctly; VIES logic skips domestic cases.

Most pricing issues don’t break immediately – they show up during audits or disputes.

FixMyStore helps Shopify merchants identify hidden pitfalls & issues before they become legal or revenue problems.

👉 Run a FixMyStore AI audit

Final Takeaway: Dual Pricing Is Not Optional in the EU

For EU B2B stores in 2026:

- Dual pricing is a legal requirement

- A conversion booster

- And a trust signal

Shopify calculates VAT but it doesn’t display it transparently.

That’s why dedicated tools like F: VAT Dual Price Display B2B exist.

Want to Go Further?

Dual pricing is just one part of a compliant EU Shopify setup.

FixMyStore helps merchants audit:

- Pricing transparency

- VAT exemption logic

- Checkout UX

- App conflicts

- B2B readiness

👉 Explore FixMyStore audits at FixMyStore.com